02.12.2025

Smart Battery Cycling Delivers Big Savings for Manufacturing Site

Manufacturers are under growing pressure to reduce energy costs, increase resilience and meet sustainability targets - all at the same time. But many still overlook one of the most immediate opportunities for cost reduction: intelligently cycling an on-site battery based on real wholesale price signals.

In this case study, we explore how our client, referred to here as Riverton Components for confidentiality, transformed its energy costs by moving from a simple DUoS-only setup to an advanced wholesale optimisation strategy powered by VEST.

The results? High-six-figure annual returns during volatile years and continued strong performance even as markets stabilised.

The Challenge

Like many manufacturers, Riverton Components consumes large amounts of electricity during fixed production hours. Their on-site battery was originally installed to:

Support resilience

Reduce peak demand charges

Deliver limited DUoS avoidance

But in its default setup, the battery wasn’t unlocking anywhere near its full economic potential.

Riverton approached VEST to understand:

Whether wholesale optimisation would materially improve returns

How volatile the opportunity might be

Whether modelling could quantify the value of deeper flexibility

The Wholesale Market Opportunity

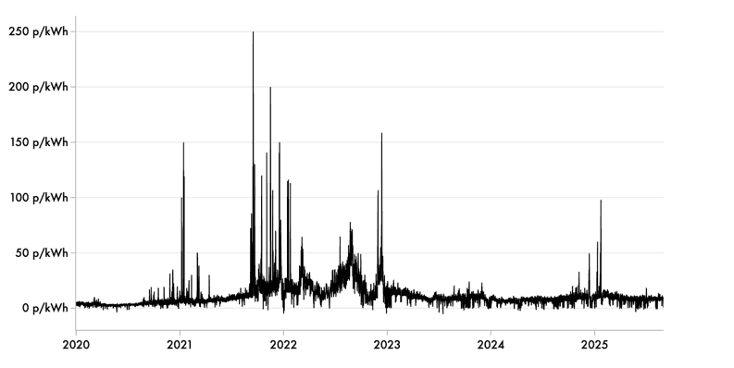

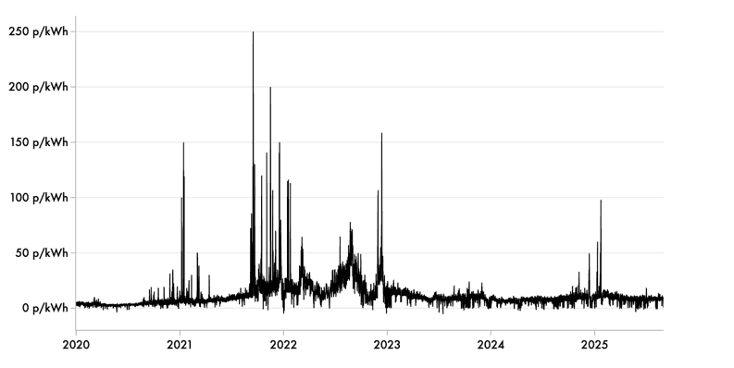

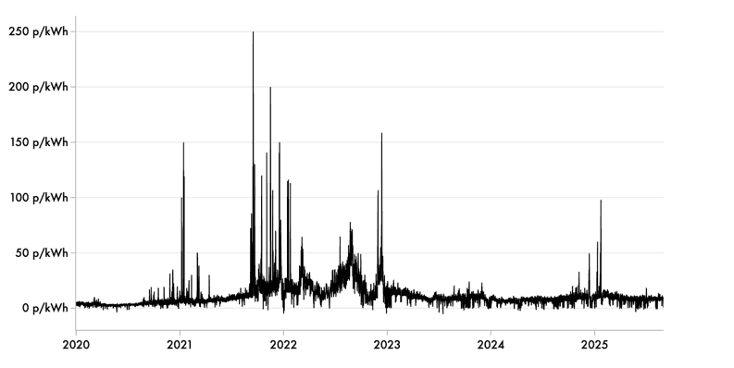

The chart below (2020–2025) shows UK wholesale price volatility, including the 2021–2022 energy crisis.

Periods of extreme spikes created lucrative charge-low, discharge-high opportunities, but only if you had the intelligence to act in real time.

(Wholesale price volatility chart 2020–2025)

This became the foundation for Riverton’s strategy: align the battery with wholesale signals every day, instead of running it on a static DUoS schedule.

Performance Comparison: DUoS-Only vs Smart Wholesale Optimisation

Below is a summary of Riverton’s modelled revenue by year, comparing:

Simple Optimisation: DUoS avoidance only

Advanced Optimisation: Wholesale + DUoS optimisation via VEST’s AI-driven trading logic

Year | Simple (DUoS) | Advanced (Wholesale + DUoS) |

|---|---|---|

2021 | £23.8k | £232k |

2022 | £24.0k | £335k |

2023 | £27.9k | £145k |

2024 | £26.9k | £110k |

2025 (11 months) | £30.0k | £118k* |

*2025 figures are based on maximum theoretical returns at 2 cycles per day, providing a fair comparison across years.

What the Data Shows

1. Wholesale optimisation dramatically outperforms DUoS

Even in a “normal” year, wholesale optimisation delivers 4–8x higher returns.

In volatile years (2021–2022), the uplift reaches 10–14x.

2. The battery becomes a revenue asset, not just a cost-saving tool

Instead of shaving charges a few times a week, Riverton’s battery was now earning value multiple times a day based on live price signals.

3. Returns remain consistent even as markets stabilise

While volatility reduced post-2023, Riverton still achieved £110k–£145k per year, far above the DUoS baseline.

4. Cycling remains within healthy parameters

The model uses a conservative 2 cycles/day, aligned with manufacturer warranties, ensuring long-term asset protection.

Operational Impact for Riverton Components

Implementing VEST’s optimisation platform led to several immediate benefits:

Lower operational costs

Riverton reinvested the annual savings into automation upgrades and staff training.

Improved carbon performance

More efficient cycling reduced peak-hour import and improved Riverton’s carbon intensity score.

Greater energy resilience

The system preserved a programmed state of charge for backup during production-critical hours.

Board-level confidence in energy strategy

Data-backed modelling helped the leadership team plan capital expenditure and forecast future grid impacts with far greater accuracy.

Why This Matters for UK Manufacturers

Most industrial businesses still operate batteries on simple schedules, leaving six-figure value on the table.

Wholesale optimisation offers:

Significant new revenue streams

Reduced exposure to peak price events

Better use of existing assets

Future-proofing ahead of locational pricing, tighter grid constraints, and rising demand charges

VEST’s modelling engine enables any manufacturer to understand this opportunity, before making changes or investing in additional hardware.

Conclusion

Riverton Components is a powerful example of what’s possible when manufacturers move beyond basic DUoS cycling and embrace intelligent battery optimisation.

Over five years, their system delivered:

£132k total DUoS-only savings

More than £900k through smart wholesale optimisation

The same hardware but a completely different return profile.

If your site has a battery (or you’re considering one) VEST can model the full savings and revenue potential for your exact consumption, tariff, and asset configuration.

Want to see what your battery could earn?

We can run a full optimisation model for your site, including:

Wholesale + DUoS + Red/Amber/Green analysis

Full cycling strategy

5-year ROI forecast

Carbon performance improvements

Book a modelling session with the VEST team.

Manufacturers are under growing pressure to reduce energy costs, increase resilience and meet sustainability targets - all at the same time. But many still overlook one of the most immediate opportunities for cost reduction: intelligently cycling an on-site battery based on real wholesale price signals.

In this case study, we explore how our client, referred to here as Riverton Components for confidentiality, transformed its energy costs by moving from a simple DUoS-only setup to an advanced wholesale optimisation strategy powered by VEST.

The results? High-six-figure annual returns during volatile years and continued strong performance even as markets stabilised.

The Challenge

Like many manufacturers, Riverton Components consumes large amounts of electricity during fixed production hours. Their on-site battery was originally installed to:

Support resilience

Reduce peak demand charges

Deliver limited DUoS avoidance

But in its default setup, the battery wasn’t unlocking anywhere near its full economic potential.

Riverton approached VEST to understand:

Whether wholesale optimisation would materially improve returns

How volatile the opportunity might be

Whether modelling could quantify the value of deeper flexibility

The Wholesale Market Opportunity

The chart below (2020–2025) shows UK wholesale price volatility, including the 2021–2022 energy crisis.

Periods of extreme spikes created lucrative charge-low, discharge-high opportunities, but only if you had the intelligence to act in real time.

(Wholesale price volatility chart 2020–2025)

This became the foundation for Riverton’s strategy: align the battery with wholesale signals every day, instead of running it on a static DUoS schedule.

Performance Comparison: DUoS-Only vs Smart Wholesale Optimisation

Below is a summary of Riverton’s modelled revenue by year, comparing:

Simple Optimisation: DUoS avoidance only

Advanced Optimisation: Wholesale + DUoS optimisation via VEST’s AI-driven trading logic

Year | Simple (DUoS) | Advanced (Wholesale + DUoS) |

|---|---|---|

2021 | £23.8k | £232k |

2022 | £24.0k | £335k |

2023 | £27.9k | £145k |

2024 | £26.9k | £110k |

2025 (11 months) | £30.0k | £118k* |

*2025 figures are based on maximum theoretical returns at 2 cycles per day, providing a fair comparison across years.

What the Data Shows

1. Wholesale optimisation dramatically outperforms DUoS

Even in a “normal” year, wholesale optimisation delivers 4–8x higher returns.

In volatile years (2021–2022), the uplift reaches 10–14x.

2. The battery becomes a revenue asset, not just a cost-saving tool

Instead of shaving charges a few times a week, Riverton’s battery was now earning value multiple times a day based on live price signals.

3. Returns remain consistent even as markets stabilise

While volatility reduced post-2023, Riverton still achieved £110k–£145k per year, far above the DUoS baseline.

4. Cycling remains within healthy parameters

The model uses a conservative 2 cycles/day, aligned with manufacturer warranties, ensuring long-term asset protection.

Operational Impact for Riverton Components

Implementing VEST’s optimisation platform led to several immediate benefits:

Lower operational costs

Riverton reinvested the annual savings into automation upgrades and staff training.

Improved carbon performance

More efficient cycling reduced peak-hour import and improved Riverton’s carbon intensity score.

Greater energy resilience

The system preserved a programmed state of charge for backup during production-critical hours.

Board-level confidence in energy strategy

Data-backed modelling helped the leadership team plan capital expenditure and forecast future grid impacts with far greater accuracy.

Why This Matters for UK Manufacturers

Most industrial businesses still operate batteries on simple schedules, leaving six-figure value on the table.

Wholesale optimisation offers:

Significant new revenue streams

Reduced exposure to peak price events

Better use of existing assets

Future-proofing ahead of locational pricing, tighter grid constraints, and rising demand charges

VEST’s modelling engine enables any manufacturer to understand this opportunity, before making changes or investing in additional hardware.

Conclusion

Riverton Components is a powerful example of what’s possible when manufacturers move beyond basic DUoS cycling and embrace intelligent battery optimisation.

Over five years, their system delivered:

£132k total DUoS-only savings

More than £900k through smart wholesale optimisation

The same hardware but a completely different return profile.

If your site has a battery (or you’re considering one) VEST can model the full savings and revenue potential for your exact consumption, tariff, and asset configuration.

Want to see what your battery could earn?

We can run a full optimisation model for your site, including:

Wholesale + DUoS + Red/Amber/Green analysis

Full cycling strategy

5-year ROI forecast

Carbon performance improvements

Book a modelling session with the VEST team.

Manufacturers are under growing pressure to reduce energy costs, increase resilience and meet sustainability targets - all at the same time. But many still overlook one of the most immediate opportunities for cost reduction: intelligently cycling an on-site battery based on real wholesale price signals.

In this case study, we explore how our client, referred to here as Riverton Components for confidentiality, transformed its energy costs by moving from a simple DUoS-only setup to an advanced wholesale optimisation strategy powered by VEST.

The results? High-six-figure annual returns during volatile years and continued strong performance even as markets stabilised.

The Challenge

Like many manufacturers, Riverton Components consumes large amounts of electricity during fixed production hours. Their on-site battery was originally installed to:

Support resilience

Reduce peak demand charges

Deliver limited DUoS avoidance

But in its default setup, the battery wasn’t unlocking anywhere near its full economic potential.

Riverton approached VEST to understand:

Whether wholesale optimisation would materially improve returns

How volatile the opportunity might be

Whether modelling could quantify the value of deeper flexibility

The Wholesale Market Opportunity

The chart below (2020–2025) shows UK wholesale price volatility, including the 2021–2022 energy crisis.

Periods of extreme spikes created lucrative charge-low, discharge-high opportunities, but only if you had the intelligence to act in real time.

(Wholesale price volatility chart 2020–2025)

This became the foundation for Riverton’s strategy: align the battery with wholesale signals every day, instead of running it on a static DUoS schedule.

Performance Comparison: DUoS-Only vs Smart Wholesale Optimisation

Below is a summary of Riverton’s modelled revenue by year, comparing:

Simple Optimisation: DUoS avoidance only

Advanced Optimisation: Wholesale + DUoS optimisation via VEST’s AI-driven trading logic

Year | Simple (DUoS) | Advanced (Wholesale + DUoS) |

|---|---|---|

2021 | £23.8k | £232k |

2022 | £24.0k | £335k |

2023 | £27.9k | £145k |

2024 | £26.9k | £110k |

2025 (11 months) | £30.0k | £118k* |

*2025 figures are based on maximum theoretical returns at 2 cycles per day, providing a fair comparison across years.

What the Data Shows

1. Wholesale optimisation dramatically outperforms DUoS

Even in a “normal” year, wholesale optimisation delivers 4–8x higher returns.

In volatile years (2021–2022), the uplift reaches 10–14x.

2. The battery becomes a revenue asset, not just a cost-saving tool

Instead of shaving charges a few times a week, Riverton’s battery was now earning value multiple times a day based on live price signals.

3. Returns remain consistent even as markets stabilise

While volatility reduced post-2023, Riverton still achieved £110k–£145k per year, far above the DUoS baseline.

4. Cycling remains within healthy parameters

The model uses a conservative 2 cycles/day, aligned with manufacturer warranties, ensuring long-term asset protection.

Operational Impact for Riverton Components

Implementing VEST’s optimisation platform led to several immediate benefits:

Lower operational costs

Riverton reinvested the annual savings into automation upgrades and staff training.

Improved carbon performance

More efficient cycling reduced peak-hour import and improved Riverton’s carbon intensity score.

Greater energy resilience

The system preserved a programmed state of charge for backup during production-critical hours.

Board-level confidence in energy strategy

Data-backed modelling helped the leadership team plan capital expenditure and forecast future grid impacts with far greater accuracy.

Why This Matters for UK Manufacturers

Most industrial businesses still operate batteries on simple schedules, leaving six-figure value on the table.

Wholesale optimisation offers:

Significant new revenue streams

Reduced exposure to peak price events

Better use of existing assets

Future-proofing ahead of locational pricing, tighter grid constraints, and rising demand charges

VEST’s modelling engine enables any manufacturer to understand this opportunity, before making changes or investing in additional hardware.

Conclusion

Riverton Components is a powerful example of what’s possible when manufacturers move beyond basic DUoS cycling and embrace intelligent battery optimisation.

Over five years, their system delivered:

£132k total DUoS-only savings

More than £900k through smart wholesale optimisation

The same hardware but a completely different return profile.

If your site has a battery (or you’re considering one) VEST can model the full savings and revenue potential for your exact consumption, tariff, and asset configuration.

Want to see what your battery could earn?

We can run a full optimisation model for your site, including:

Wholesale + DUoS + Red/Amber/Green analysis

Full cycling strategy

5-year ROI forecast

Carbon performance improvements

Book a modelling session with the VEST team.